UX Architect, UI Design, UX Design, UI Development

July 2016–May 2017

Application Processes

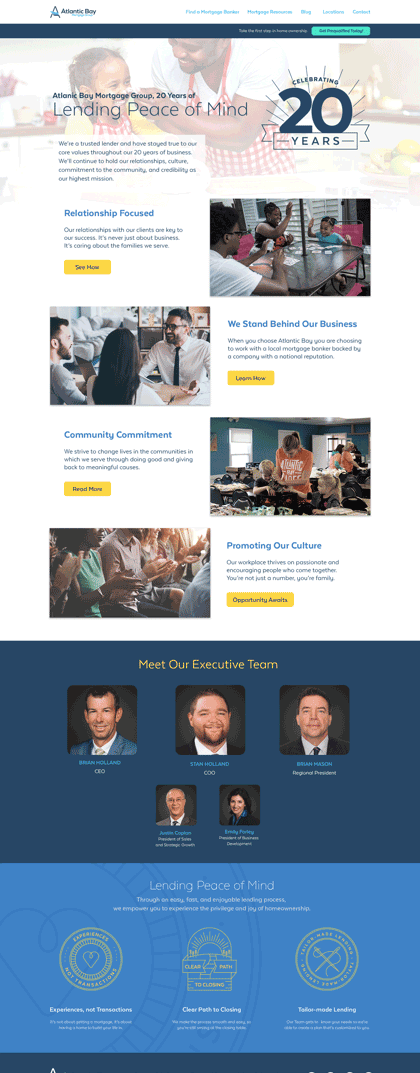

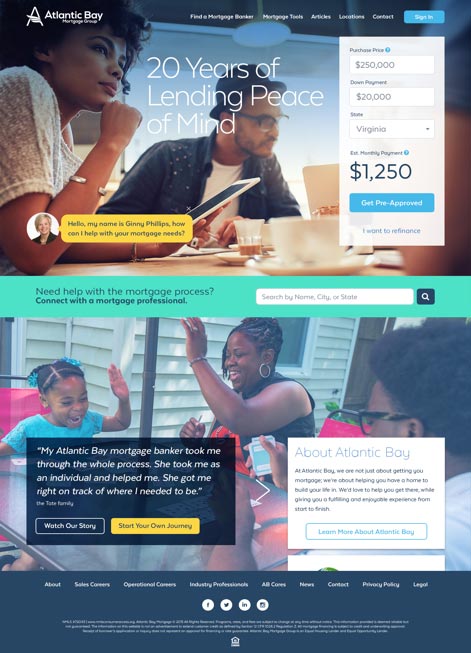

I joined Atlantic Bay Mortgage in the summer of 2016 as a User Experience Architect. My first responsibly was to help oversee the rebranding of all marketing and media materials. As well as focus on the alignment of their digital presence. The company desired to stay competitive in the market space. They hoped by introducing a better-performing website that allowed the user to start loan applications online, that this new product could take their online brand to the next level.

Asset Allocation

The brand refresh was needed, as a vast collection of slightly different marketing pieces existed in their library. Led by the creative director. I assisted in gathering and organizing marketing collateral into groups by use type for a design audit. During this project, the creative director abruptly left the company. Citing my previous experience in that role, I stepped in to oversee the implementation and approval processes of the brand realignment project. I also assisted the development team in updating the company's digital assets.

Running Audits

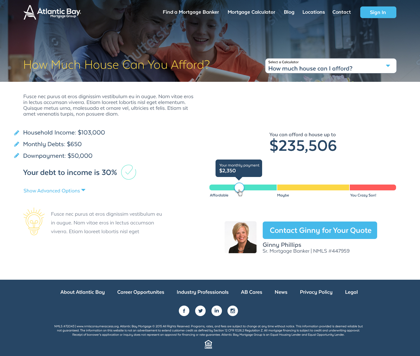

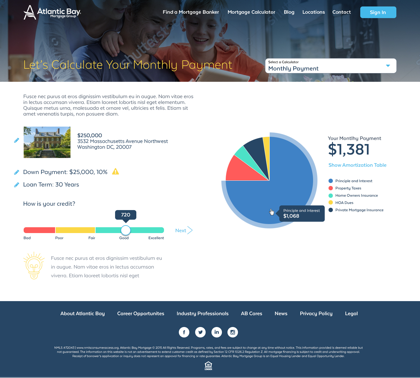

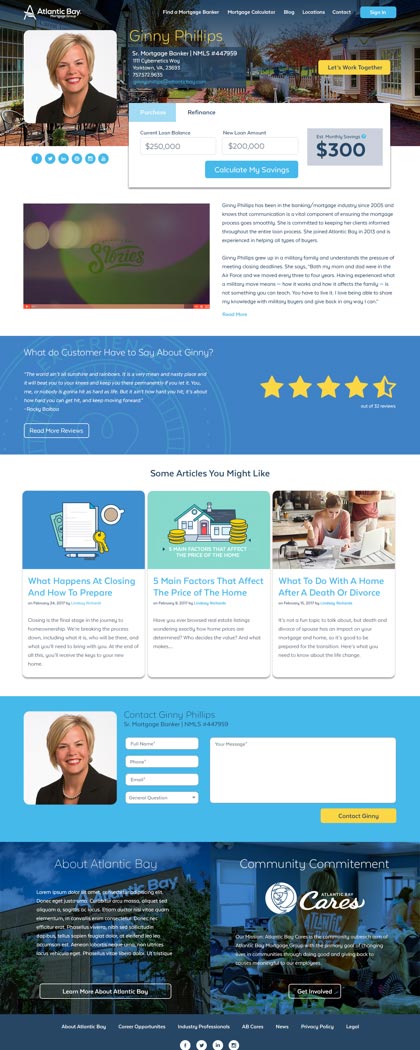

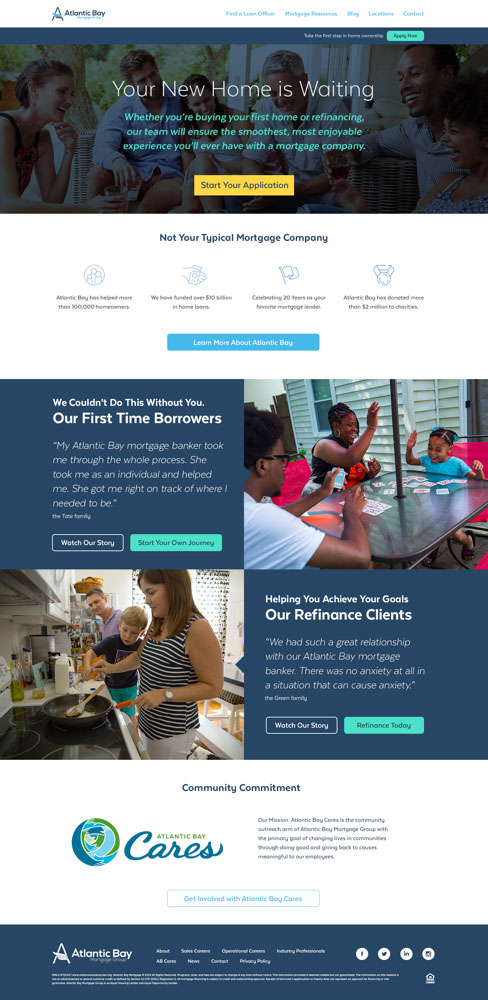

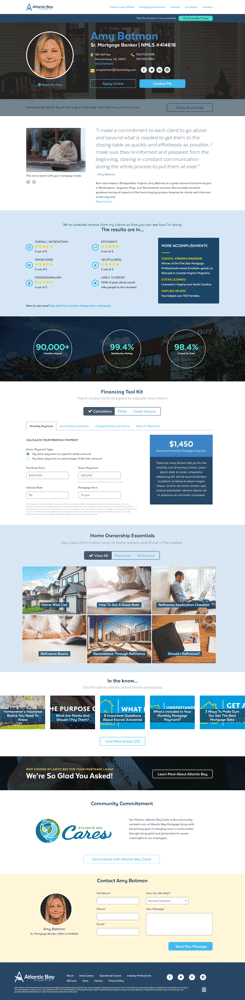

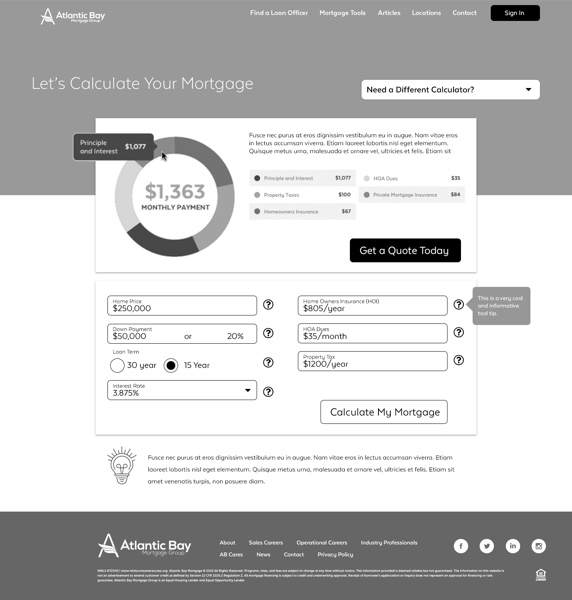

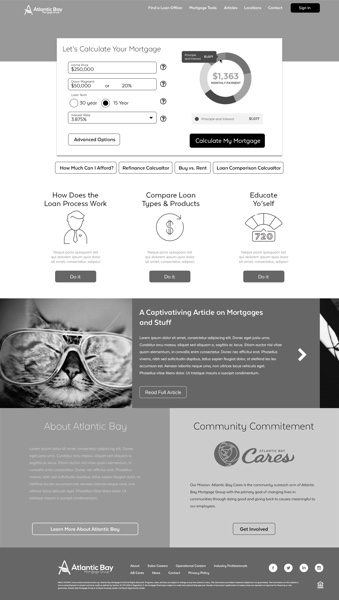

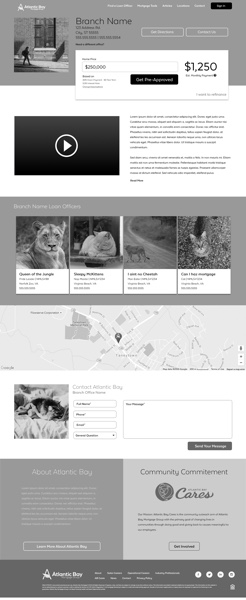

While the brand refresh was happening, I began gathering user data on the existing consumer website. My review included historical traffic data, running user heat maps on key conversion pages of the website, and interviews with SME's. From my research, I learned a lot about all the information that could be required to apply for a mortgage (it's even more than you think). Using this data and information gleaned from user and stakeholder interviews, I began to create wireframes and clickable prototypes for workflow validation, covering new user conversion goals and establishing new online application processes. An additional business goal, similar to the real estate industry I had previous experience within, was increasing the exposure of their extensive network of mortgage bankers.

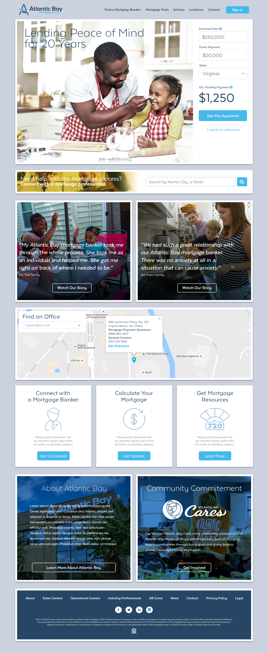

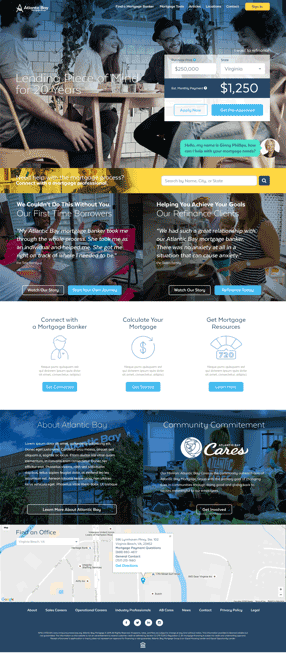

Once internal users validated the wireframes, I started creating high-fidelity mocks and experimenting with homepage layouts. Drawing upon my experiences working with numerous national real estate brands, I set up options for several lead conversion test plans.

A Friendly Face

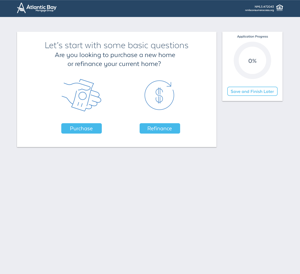

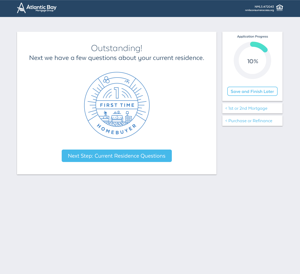

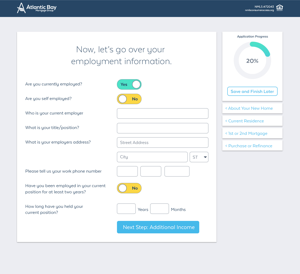

The other huge piece of this UX puzzle was how to take a highly complex and variable-driven application process, and present it in an easy-to-understand manner. I started by researching how this challenge was handled by competitors, and also how similarly complex online user transactions were designed. From these findings, we decided that a guided loan process would be the best solution for our users. Next was documenting decision tree diagrams, and mapping all the possible user pathways that could be taken through a loan application. These turned into form prototypes for user testing.

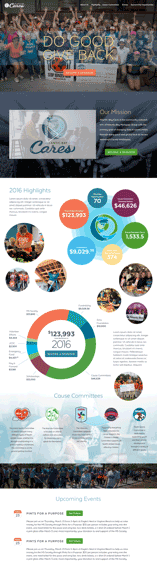

Numerous rounds of revisions were iterated through, resulting in layout and UI refinements, before a development firm was hired to facilitate the development of what we had planned for the loan wizard. I then turned my attention to the company consumer website and several microsites, covering additional business goals such as recruitment and charity initiatives.

Cancelation Request

While I was working on establishing use cases for this online mortgage process, the company decided to restructure its technology and marketing teams. With that, I left Atlantic Bay with the hope that the user experiences I had documented would be developed. Even though I was unable to see the product I helped create through release, I am confident it would have been successful, and I regret not having the opportunity to refine and improve it with time and testing.